One of the things to dread when owning your own house is Cold-Calls

Cold Calls are essentially where someone makes contact with you, without knowing anything about you, In hopes to glean information from you and sell you a product, Sell your Info, or in some cases, Take your Assets or Identity.

They come 3 forms:

- Mail

- Phone

- In person

As an I.T. Admin, and former I.T. Recruiter (Involves Cold Calling), I've got a fairly keen sense of when something is a hoax, or too good to be true. Quite a few things set off my Spidey sense.

Mail:

Probably the easiest to discard and detect items high on the bogus scale.

- Prizes and Raffles

- 3rd Tier Gas Companies

- "URGENT" letters without your name on them

- "PAST DUE" notices without your name on it

- "Pre approved" fake paper credit cards

Bottom line is, if it seems even remotely fishy, and your name isn't on the letter, its junk. I open everything anyway, unless its clearly just spam mailers. I love the fact that I get Bell Internet mailers even though They don't service my area is hilarious. Such a waste of money on their part.

Phone:

Probably one of the more successful and "safe" ways of scamming someone, Is via Phone.

The Phone has this sense of closeness and personal communication that lacks in Mail or E-Mail. And, if you call BS, they can just hang up and call again later.

Today, I got an awesome phone call. I had apparently filled out a ballot at a store in the GTA that entitled me to a free vacation.

The man on the phone was very accented, and the area code was 716, Buffalo (which I quickly googled while trying to understand him)

I had two choices, a 5 day 4 night stay at any hotel in America, including Niagara falls (which is in "On-tear-eo" Or 4 days 3 nights at a resort in Mexico...

Both choices were open during the whole year, at my leisure.

I asked what the catch was. (There's always a catch) he said there was none. No cost to me. I Started asking questions, and he was asking why I wasn't excited. I told him I wasn't aware I filled out a form at walmart or zellers (?!?) I asked for more details.

he went very quickly to a scripted "I am calling from SuiteLife Vacations a BBB accredited organization at suitelifevacations dot com. You are 1 out of 150 winners of a choice of our 2 prizes.

I had more questions, but he quickly pushed the call along and asked why I wasn't excited. I flatly claimed that this seemed too good to be true and if I didn't get more details, I'd be hanging up. he started the script again, and I interrupted with "Whats the catch"

He went on a variation of his script saying that word of mouth advertising about their services is the best kind (true) and that My prize was usable untilt he end of 2013, to a destination of my choice.

He asked some very generic questions which I simply responded yes or no. He asked if My household income was 70 thousand 70 hundred. I just said yes. he asked if I lived with someone, I said yes.

I then asked him what information was on the ballot, and he deflected, saying that his manager would call me back with my prize code. I hesitantly said OK... and then hung up

10 minutes later, I surprisingly actually got a call from his "manager"

However, I had googled. This place is a borderline illegal scam.

Basically, your "prize" is a trip to a hotel anywhere in the US, where you pay all transportation, food, and fees/taxes. Your hotel is "free" but you have to pay $17 US to reserve your prise booking, and then $40 in Booking Fees, and then $75 for some gratuity fee or something.

On top of that, you have to drive to Woodbridge (industrial area) for a 1 hour meeting, where they promise you dinner (steak or chicken) and then don't deliver unless you buy an upgraded package.

Many people have reported flying down to their destination, renting a car, and showing up at their "hotel" just to pay all but the basic 40 dollars a night rate (Taxes, fees, etc not included)

So, When the guy called back, I asked him one simple question: "Whats my name?"

He started the spiel of "I am calling from suitelife"... I interrupted him and said "What is my name?... if I filled out a ballot, you'd have more than just my phone number."

(I started to laugh thinking of American Pie: "Say my name B!tch")

I told him that any reputable company would know the name of someone who just won a prize. i told him i also googled the company, and that you have a C- Rating on BBB, and there are many unresolved complaints of people being stranded at your destinations. I told him to remove me from his caller list and databases. He got angry at me for 'turning down a prize" and hung up on me mid sentence.

Just one example!

Bottom line: If someone is calling you, They should have your info already. Don't give it up willingly. Ask them where they got your number. Ask them your own address. Don't give them anything they don't already have. Don't verify what they DO have until you are sure they are reputable. Check the

BBB Website for their company name. Not listed or below B+ Grade? Hang up!

Also, if someone calls from Microsoft - Hang up.

Final type: In Person

This is a tough one. Most people are naturally weary of someone coming to their door. As soon as I see a clipboard, I know someone is selling something (Cookies, Gas,

Frozen meat?!?)

But if there's no clip board, I'm thinking "this guy is sketchy..." So the Clip Board is a double edge sword.

When someone comes to your door,

Common sense is required.

- Don't sign anything.

- Don't Show Fear.

- Don't Let them run the conversation - Control it yourself, Ask them questions. It'll throw them off of their routine, but it'll also get you the information you need to quickly Dismiss or engage them further if you want.

- Don't tell them when you won't be home, Just tell them when the "best time" to reach you is.

- Don't Invite them in - Let them freeze and talk to them from the doorway.

- Don't be mean. There's a few reasons why I say this:

If you're not memorable, its a good thing

If they are someone with bad intentions, You're more likely to be targeted

If you're not interested, Speak strongly but nicely that you are not interested.

Sometimes, people don't get the hint

I've never had to do this, I don't know anyone who's had to do this, but I've heard of a few things that can help you if you have someone showing up regularly who is not wanted at all, and won't get the hint,

now matter how nice, or firm you are. First, Find out what company/group they are from. This way, you can confirm they are from the same group/company and are "harassing" you and it will allow you to make good on the end all of rejection statements:

"Please leave. This is your notice that YOU, and ALL the Employees/Members of your company/group are no longer permitted on MY property. Further visits will be construed as Harassment, and anyone found on MY property in the future will be photographed and/or charged with trespassing"

That'll pretty much send anyone running for the hills, and is completely legal and not a physical threat that can come back to bite you in the ass.

Harassment: (Quoted from Canadian Criminal Code, Section 264)

"No person shall, without lawful authority and knowing that another person is harassed or recklessly as to whether the other person is harassed, engage in (the following) conduct ...that causes that other person reasonably, in all the circumstances, to fear for their safety or the safety of anyone known to them:

- Repeatedly following from place to place the other person or anyone known to them;

- Repeatedly communicating with, either directly or indirectly, the other person or anyone known to them;

- Besetting or watching the dwelling-house, or place where the other person, or anyone known to them, resides, works, carries on business or happens to be; or

- Engaging in (such) threatening conduct directed at the other person or any member of their family."

Trespassing:

Is kind of a fluff charge. If someone is trespassing, you call the police. If they are still on site, you explain tot he police that you asked them to leave, and they are trespassing. They'll issue a trespassing warrant. If that person breaks the conditions (effectively a restraining order) and shows up again, THEN they are in some deep doodoo. That's what the "photographed" bit is for.

You do have the legal right to "defend" your real property or dwelling from trespassers.

(within reason) a Trespasser is anyone you have told are no longer welcome on your property or dwelling.

The bottom line:

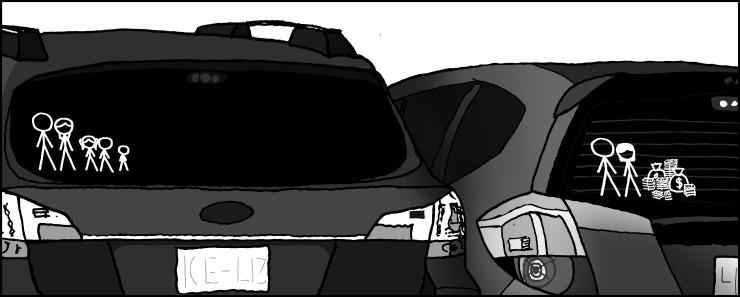

Home Ownership means you have some sort of asset. (aka "worth")

You have something that everyone else wants to get -

Some in less honest ways then others.

Your "firewall" is your common sense - sadly there isn't an anti-spam program for Life!

It feels like my money is going down a hole lately...

It feels like my money is going down a hole lately...