"Live Below your Means"

Megan and I have a "4 walls" approach to our personal finances - As in, Our personal finances never leave "these four walls" and we don't talk about them with anyone else.

Talked it over with Megan, and because this is mostly about me, and it is the past (albeit a past that I'm still paying for) I'm OK to go a little more into depth.

If there are any students out there reading this, this is heads up of what is to come.

My Past:

Generally, You inherit your first bank account from your parents. The one they put your birthday money in when you were a kid. That's what happened to me. Living at home, I didn't have a need for even a debit card until I was 18 or so. As a result, I actually had a bit of money in my savings going into college.

That dried up. Completely. College was like this whirlwind of awesome times, that was fueled by money.

Problem Number 1:

Before it dried up, Royal bank gave me a visa card. I didn't ask for it - They just offered me one.

What 19 year old Alex saw was this: Free money, No monthly fees.

Problem number 2:

When I graduated college, I got a job that was about 50km away via 407 ETR, and they told me I HAD to have a car. So I bought my Mazda3, new. Its an awesome car, Its been great to me, and i'm going to drive it until it dies, or is not financially feasible to keep maintaining.

What ended up happening is that I was working, just to own my car. I barely made any money. It was a sales job, and my base salary barely covered my car and basic food/entertainment. When I made a deal (placed someone) I'd get about a $1,200 Payday, which I felt compelled to "reward" myself with, rather than save. (or pay off the little bit I had put on my visa)

Problem number 3:

The moment I got a better paying job, I was able to "afford" to move out. I had no "safety net" of cash anywhere, and I did not have the ability to "save" any money, as about 95% of my paycheque used for rent, Insurance, Gas, car payments, and food. So when money was eaten up by "unforeseen" expenses (like $500 side windows when my car was broken into 3 times) The visa, Otherwise known un-affectionately as "Cousin Vinnie", came in to "save the day"

Problem number 4:

Growing up, my parents rarely just bought us big ticket items. Generally what would happen is that I would be required to save up money to buy what I wanted (Sound Card, Bicycle, PlayStation, CD-Rom Drive, Computer, etc) (I was a nerdy kid) and most of the time, My parents would swoop in at the last second (usually at the checkout counter) and cover half of it as a Christmas gift or birthday gift or what have you. I never expected it, and I knew if I ever DID expect it, I'd be sorely surprised. I had to "earn" something completely, even if I didn't have to pay for it completely.

Apparently 8 year old Alex was smarter than 19-23 year old Alex.

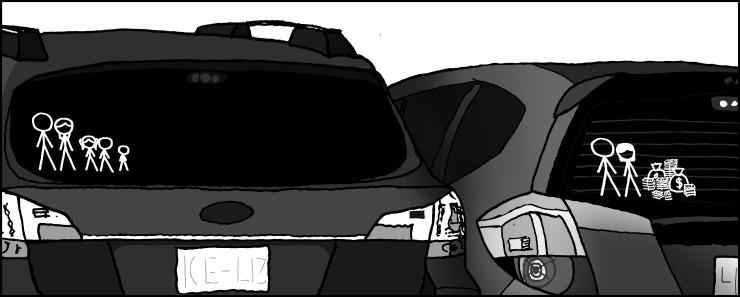

This SHOULD have taught me the value of a dollar, and how to save my money... But once I moved out, I developed this "I'm an adult now and need to live like a successful adult" mentality.

I had this stupid impression that I didn't have to live thrifty or lower my quality of life... I just needed to make more money.

I had a false sense of entitlement, and bought things on impulse (I'd research the best value/features of whatever I was buying, and then buy it.) I still battle impulsive tendencies to this day, and there's a new 8 gallon aquarium I bought after Christmas in our foyer which reminds me daily of this fact.

So: When moving out and moving up in the world, If you can't buy it with cash because you don't have any... Don't Buy it.

Back on topic.

If I was spending every penny (and then some) just to "live"... What did I do when something out of the blue happened?

Cousin Vinnie. (The visa)

Royal bank just kept upping the limit without asking me, and I didn't complain. I don't ever think it was maxed out, but it took a while to realize I was paying well over 100 bucks in interest a month, and that it had become this monster.

So, a little aside - Girls - You cost a LOT to date.

Enter Megan. She moved out on her own about a year before I met her. Had an old used car, No monthly payments, and her idea of entertainment was really just sitting around, reading a book, and watching Dr. Phil. She was the Gift Card/Coupon queen, and luxuries were usually a result of Birthday/Christmas, she just managed them so she would have them last throughout the year.

I learned a thing or two, but She lived in Hamilton, I in Mississauga. I Still lived AT my means, but considering the amount of travel/date money I was spending, I was able to shift around my "costs" to keep my bank balances relatively level. Only once we moved in together (aka I stopped buying dinner for us both every other night) did I successfully lower our "quality of life" to a level that I could make headway and pay back "Cousin Vinnie"

Bottom line...

Keep your monthly expenses UNDER 60% of your wages. Put 20% away for Savings/RRSP, but the other 20% toward "spendable" money. (Groceries, Clothes, Entertainment.)

Monthly expenses include:

- Rent/Mortgage

- Insurance

- Water, Hydro, Natural gas

- Car Payments (and insurance)

- Phone

- Internet (Lets be honest, Internet is a Utility/Tool... TV is a luxury)

- I like to include gasoline

- Loan Payments

If you have any leftover money at the end of the month... reward yourself by putting it aside for a rainy day - That way you won't be screwed over when something bad happens. (and it WILL happen... budget for it!)

If you are paying off debt you've already got... it pays to pay it faster. Interest is really like that douchebag talking a little too loud about their personal workout routine at a nice restaurant - The longer you are aware of it, the more it pisses you off.

These are all lessons my parents taught me growing up, but I was just too young and stupid to heed their advice.

...now I'm just young and good looking ;-)

Next post is about

Excellent Alex! And even the very best of budgets can get into trouble when all the service providers raise their rates at the same time!

ReplyDelete