As a home owner... you will have nightmares and lose sleep worrying about the biggest investment of your life...

My dad actually asked me how I slept the first night in our house. My answer was "like a baby" because It had been a CRAZY and long day. He asked if I had any nightmares. I thought it was silly... but now, almost 6 months later, I know EXACTLY what he was getting at.

Nightmare #1

If you are going to have a leaky basement... it will be today or tomorrow.

Why?

Think of the weather the last few weeks.

COLD. Bitter cold. This cold freezes the ground, and where we are (Ontario, Canada) this means the ground can be frozen to 4 feet deep.

Frozen ground does not absorb water. It lets the rain flow over it.

However, your nice toasty warm house (and its basement) heat up the ground a few feet around your house - So it thaws first once the weather gets nicer. This makes a very nice little, thawed area of ground that you mind as well call "the water holding area", all round your house.

Now, the temperature has warmed up. All the snow has melted VERY quickly, providing tons of water and saturating what little Unfrozen ground there was.

Now throw in a downpour. If the ground on your property isn't well graded (sloping away from your house) You now have your house basically sitting in a bathtub of water. Even the smallest crack will start to allow water in.

So, Every morning, and evening, I look in my basement for signs of water. None yet.

Nightmare #2

Now, Throw in the wind. And the Cold/Hot/Cold/Hot weather we've been having.

This is the weather that kills roofs.

Hot weather sets in. Water on your roof. Flash freeze. That water which is in the cracks between your shingles, which the wind may have driven up a bit under the shingles (perfectly normal) Is now freezing, and EXPANDING. This wears out your shingles. Even expanding between the gravel stuck to your shingles with tar. So the gravel comes off, your shingles lift a bit... and then the heavy wind comes.

So, Every Morning, I check the upstairs for a leak. Nothing crazy... but I just glance at the ceilings in each room. Just in case. Nothing yet!

Nightmare #3

Things that go bump in the night.

Lately, with the wind, I've been hearing a quiet metallic screech while I lay in bed. I'm fairly sure its my rotary vent in the attic just squeaking a bit...

But what if its not? I did put in a new vent for the bathroom fan. What if I screwed it up? What if its a bird or other critter in my attic?

Whats made it worse is that the air purifier in our room started to smell "hot" so we've had it off for the last couple of days. The lack of white noise lets me hear EVERYTHING.

But yes, every time I hear a sound in the house, I think "I wonder what that is, and if its going to cost me money eventually..."

Worrying about all these things is perfectly natural - (I hope!)

The important thing is to prepare for it. In I.T., we have something called "DR" which is "disaster recovery"

Basically a plan of what do you need to do if Disaster strikes.

Odds are that none of the above will ever happen (Especially if you properly maintain your house!)

But... Because I'm weird, I made a mental plan for each "nightmare" scenario above.

If I found out for some reason my Attic was leaking, I'd get up there STAT and see if I could find where its coming from and put a bucket in the Attic to prevent further damage to my ceilings. (I keep a few Deck Boards in the attic for moving around) I'd call a roofer right away.

For the leaky basement, the second I see any water, I have a simple floating laminate floor. I'd disassemble and pull that away from the leak, put down some towels and get my dehumidifier by there. I'd also (probably fruitlessly) put some tarps down roughly where its leaking and slope them away from the house. Also, My eaves troughs drain into a tube in the ground. I'd pull those out, and instead of going into the ground, i'd run them away from the house via these little plastic "aqueduct" kind of things: (see right)

As for that noise... I'll poke my head up there on a windy day when I can borrow the ladder from my Father in Law. Maybe with a bat... just in case my nightmares come true :-p

Sweet dreams all...

Note: I've finished my Kitchen "shuffle" but my pre-written blog posts... are no longer valid - Lots of Unexpected items. I'll hopefully be able to re-write them this weekend to post up by Sunday.

Stay tuned!

Written by a First Time Home Owner, the mission of this blog is to both entertain and inform you of the challenges of buying and owning your first home. First dozen posts are related to the buying process, and later posts covering DIY repairs, Upgrades, and just the daily aspects of running a home

Wednesday, January 30, 2013

Thursday, January 17, 2013

Why I hate my Kitchen...

So, Our Kitchen is a kind of neat layout.

However, there's three things (maybe even three and a half things) that I hate about it.

I've drawn a picture in Paint. I'll refer to this over the next couple of posts (never learned autocad, sadly...)

We have One drawer.(beside stove, facing sink near Orange star)

That's it. One drawer. It holds all our cutlery, Most knives, all of our cooking utensils, measuring devices, chop sticks, Lighters, Birthday Candles, Serving spoons etc. its a PITA to close, and things like tongs always get in the way.

I can't open my freezer door (Red Box with yellow star)

We have a "vertical split" freezer, with a ice/water dispenser in the freezer door. The breakfast bar is flush fit against the freezer, so when I open the freezer door, it hits and is stopped by this breakfast bar (which is bolted into the wall) and I can't open my Freezer door more than about 8 inches wide. Very annoying!

When I cook, the whole house stinks (Yellow stove, Green Star)

There's no Smoke Hood.

As a result, anytime I make something that requires a bit of smoke/frying, the whole house stinks for days. I'm a poster child for Glade Plug-ins (at 5 watts of power each, we've got 4 around the house... they last a month... its costing me about 20 bucks a month to counteract cooking/garlic/oil smell with linen and apple pie smells..)

The Water from the fridge tastes a bit off sometimes... (.5) (Fridge is Red with Yellow Star, blue star is water feed)

The water line from the fridge actually is routed through the floor, across the basement, back out where the stove is, and then through the wall (green star) into the bathroom sink plumbing. (Blue star)

I'm assuming that the 25 feet of plastic tubing means that there is water sitting in there for a while before it actually gets all the way to the fridge.

What am I going to do about it?

Well, I have 125 dollars in home depot money from Christmas.

The most efficient way I can improve the kitchen is to have the stove and the fridge swap places.

Logic:

The Only negative aspect I can think of is that the "hallway" between the two counter tops will be a good 4 inches narrower because of the fridge/Fridge door Handles. It will also mean people have to come into the kitchen "more" to get water... but it does make it easier to access from the dining room. All in all, An easy compromise.

Here's the plan, and the topic of my next 3 posts, as I do this over the next week (with lots of pictures, and maybe even video!)

Step 1:

Make room for the fridge!

Step 2:

Plumbing for the Fridge

Step 3:

Wiring in a 230v Plug for the stove

Step 4:

The Before and After, Conclusion, and Lessons Learned, and Next Steps.

Stay tuned! I start this weekend!

However, there's three things (maybe even three and a half things) that I hate about it.

I've drawn a picture in Paint. I'll refer to this over the next couple of posts (never learned autocad, sadly...)

We have One drawer.(beside stove, facing sink near Orange star)

That's it. One drawer. It holds all our cutlery, Most knives, all of our cooking utensils, measuring devices, chop sticks, Lighters, Birthday Candles, Serving spoons etc. its a PITA to close, and things like tongs always get in the way.

I can't open my freezer door (Red Box with yellow star)

We have a "vertical split" freezer, with a ice/water dispenser in the freezer door. The breakfast bar is flush fit against the freezer, so when I open the freezer door, it hits and is stopped by this breakfast bar (which is bolted into the wall) and I can't open my Freezer door more than about 8 inches wide. Very annoying!

When I cook, the whole house stinks (Yellow stove, Green Star)

There's no Smoke Hood.

As a result, anytime I make something that requires a bit of smoke/frying, the whole house stinks for days. I'm a poster child for Glade Plug-ins (at 5 watts of power each, we've got 4 around the house... they last a month... its costing me about 20 bucks a month to counteract cooking/garlic/oil smell with linen and apple pie smells..)

The Water from the fridge tastes a bit off sometimes... (.5) (Fridge is Red with Yellow Star, blue star is water feed)

The water line from the fridge actually is routed through the floor, across the basement, back out where the stove is, and then through the wall (green star) into the bathroom sink plumbing. (Blue star)

I'm assuming that the 25 feet of plastic tubing means that there is water sitting in there for a while before it actually gets all the way to the fridge.

What am I going to do about it?

Well, I have 125 dollars in home depot money from Christmas.

The most efficient way I can improve the kitchen is to have the stove and the fridge swap places.

Logic:

- The Fridge blocks off the breakfast bar from the rest of the kitchen

- The fridge is too far from the water feed.

- Moving the stove next to an outside wall will make it easy make a hole to outside to vent a fume hood when funds permit me to buy one.

- Eventually, I'll get a Microwave cabinet over top of the stove, mount the fume hood to that, and have more storage space, AND more counter space. (win win)

- The stove currently is beside a full height pantry cabinet, so the fridge being there won't "close off" any of the kitchen.

- The fridge is 1.5 inches deeper than the cabinets. this 1.5 inches will allow the door hinges to be unobstructed (and I'll be able to open my freezer)

- The watefeed is behind where the stove is anyway, so I'd be cutting out 15 feet of water-line to the fridge

- There's a electrical socket behind the stove already - Easy to do.

- The Fridge is over top of the Electrical panel in the basement - Easy to wire!

The Only negative aspect I can think of is that the "hallway" between the two counter tops will be a good 4 inches narrower because of the fridge/Fridge door Handles. It will also mean people have to come into the kitchen "more" to get water... but it does make it easier to access from the dining room. All in all, An easy compromise.

Here's the plan, and the topic of my next 3 posts, as I do this over the next week (with lots of pictures, and maybe even video!)

Step 1:

Make room for the fridge!

Step 2:

Plumbing for the Fridge

Step 3:

Wiring in a 230v Plug for the stove

Step 4:

The Before and After, Conclusion, and Lessons Learned, and Next Steps.

Stay tuned! I start this weekend!

Tuesday, January 15, 2013

Budgeting 101

This is almost Part 2 to my previous post: Live Below your Means

Megan and I are getting Married.

We had to decide: House, Or Wedding First.

Logic ended up winning out over emotion, and we bought the home. (it was a close decision)

Because of the First Time Home Buyer Program in Canada (where you can use up to 25,000 of your RRSP's as a down payment for a house without a tax hit if you pay it back within 15 years) we realized it wouldn't delay getting married by more than a year.

So now we're saving our "pennies", the date is set, and we're looking good to go.

How we're saving money:

Cars:

Mine is paid off, but over 180,000km. Its going to need work to keep it on the road. I plan to drive it to 300,000km if it'll let me, but I'll sell it if maintenance costs more than $300 a month averaged over 9 months. (a new car would be cheaper then)

What I realized is - Dealerships... really do deserve the name "Stealership" Mazda wanted 900 bucks to fix her door lock. It took me 86 bucks from an auto wrecker (including shipping!) and an HOUR to figure it out on my own. Dealership wanted 290 for the part, and then 4 hours labor for $790+tax (Total savings - $810 dollars)

Also replaced her rear struts, at a cost of 70 bucks to me, and a 50 dollar Torque Wrench. (dealership wanted 380 to do it - total savings $260 bucks)

I also swap over our tires from summers to winters (winter tires get you 5% off your insurance)

that's 50 bucks a year, per car (so $100) plus the 5% off your insurance)

Also - I've slowed down. Instead of doing 130 on the highway, I'm doing 110. Went from 9.0l/100km to 7.2l/100km when I'm not stuck in traffic. On the whole, I'm averaging a 15% reduction in gas (which is a lot, because I drive ~2100km a month to work and back)

Home:

Insurance

So in total, for Home, and our cars, our insurance has dropped almost $200 a month by putting it all under one account. Score!

Budgeting

Savings - This is what all the utilities come out of, Mortgage payments, etc. At the end of the month, I put a minimum of 75% of the leftovers into saving for the wedding.

Chequing - I transfer my "expendable" money to this account. if I want to buy something I generally wouldn't buy... the "spare" money in this is for that. I put about 3% of my paycheque in here. Its kind of my "guilty pleasure" money. (i.e. tech toys, Video Games, Cosmetic Car stuff, etc)

Visa: If a place accepts visa, I use my visa instead of savings. When I get home, I look at the receipts and transfer money to the visa, before it even shows up. I do this mostly for the points. It'll help with the honeymoon!

E-savings - Some money set aside for my car - its going to need some major work sooner or later.

TSFA - Its just there... I don't touch it. I consider that the "Oh crap we both lost our jobs and we're going to lose the house" emergency money. (I'll also get raped by the tax-man if I ever do touch it)

Wedding Savings: I throw as much as I think I can afford on payday, and then most (75%) of any leftovers at the end of the month. I HAVE overestimated in the past and put too much in there on payday, but rather than taking it back out a week later, I try and live like a hobo until the next payday.

The last, and KEY thing that helps me manage money is actually Royal Banks' "My Finance Tracker" It's an online money manager that lets you set budgets for each "area" of spending.

At any time, I can look up exactly how much I spent, at what store, and when. I go in every week and check to make sure everything has been categorized. All this is key to realizing where you are hemmoraging money. (Interest, Starbucks, Monthly subscriptions, Dining out, etc)

True Story:

When Megan and I started dating (when I was "wooing" her) I was HORRIFIED to discover that my "entertainment" and "Dining" categories jumped up over $1200 a month. Now a days, I make sure we have 1-2 "Date nights" a month, and hanging out with friends either is watching a movie at someones house, or playing cards for 3 hours over a 5 dollar Bubble Tea at Forever Tea Shop Much cheaper than Movie theater + Dinner (80 dollars) or something similar. We re-discovered the lost art of "cheap" dates. A walk along the shoreline and an ice-cream cone replaced a night on the town.

Track your little expenses. Coffee is a bad one. Dining out (Guilty!) is also a huge expense. Packing a lunch costs about 2-3 bucks. Buying a lunch is usually 7-12 bucks. replace dining out with packing a lunch and you're saving over 1000 bucks a year - EASY.

So, A couple lifestyle choices, and we will have "saved" ourselves the wedding that we both have been looking forward to for many years!

Megan and I are getting Married.

We had to decide: House, Or Wedding First.

Logic ended up winning out over emotion, and we bought the home. (it was a close decision)

Because of the First Time Home Buyer Program in Canada (where you can use up to 25,000 of your RRSP's as a down payment for a house without a tax hit if you pay it back within 15 years) we realized it wouldn't delay getting married by more than a year.

So now we're saving our "pennies", the date is set, and we're looking good to go.

How we're saving money:

Cars:

Cars are our biggest expense after the house. Between Gas, Insurance, payments, and Maintenance, its over $1000 a month for both our cars.

Mine is paid off, but over 180,000km. Its going to need work to keep it on the road. I plan to drive it to 300,000km if it'll let me, but I'll sell it if maintenance costs more than $300 a month averaged over 9 months. (a new car would be cheaper then)

So far, on Megan's Mazda5, I've saved over $1,000 bucks in the last 6 months. To SAVE that money, I did spend about 200 bucks in parts/tools. (For every new job, there's a new tool :-) )

What I realized is - Dealerships... really do deserve the name "Stealership" Mazda wanted 900 bucks to fix her door lock. It took me 86 bucks from an auto wrecker (including shipping!) and an HOUR to figure it out on my own. Dealership wanted 290 for the part, and then 4 hours labor for $790+tax (Total savings - $810 dollars)

Also replaced her rear struts, at a cost of 70 bucks to me, and a 50 dollar Torque Wrench. (dealership wanted 380 to do it - total savings $260 bucks)

I also swap over our tires from summers to winters (winter tires get you 5% off your insurance)

that's 50 bucks a year, per car (so $100) plus the 5% off your insurance)

Also - I've slowed down. Instead of doing 130 on the highway, I'm doing 110. Went from 9.0l/100km to 7.2l/100km when I'm not stuck in traffic. On the whole, I'm averaging a 15% reduction in gas (which is a lot, because I drive ~2100km a month to work and back)

Home:

An earlier post about LED lights, Saving energy. Simply putting my power hungry "server" computers to sleep when I'm not using them... dropped electricity usage by about 25 bucks a month

- No TV Service - Download our favorite shows.

- No Home Phone Service - Cell phones!

- Buy In Bulk/sale items- Chest freezer FTW!

- Lowered the heat - Bought an Electric Mattress heater for megan, so the housecan get down to 18*c at night, 20*c During the day. (The difference between 20 and 23*c is about 15-20 bucks a month)

- Cold water Laundry and after 7PM - saves about 40 cents a load. (4 bucks a month?)

Insurance

We switched everything over to one company (Bel-air direct)

They're not the most "friendly" company when it comes to a claim... but they are, without a doubt, the cheapest. I've been with them for 5+ years now. We just switched megan over now that we're classified as "common law" and as a result, we've stacked up discount ontop of discount:- My 5+ year loyalty bonus

- Winter tires 5%

- Car Alarm ~2.5%

- Multi Vehicle 20%

- Multi Plan (home insurance) 15%

- Good driving record which gets me a deal too. (Megan is haunted by a not-her-fault writeoff... (being t-boned by an old man running a red light SUCKS)

So in total, for Home, and our cars, our insurance has dropped almost $200 a month by putting it all under one account. Score!

Budgeting

For this, I have my own kinda method. it involves a lot of bank accounts! Its kind of like the "magic jar" method from "till debt to us part"

Savings - This is what all the utilities come out of, Mortgage payments, etc. At the end of the month, I put a minimum of 75% of the leftovers into saving for the wedding.

Chequing - I transfer my "expendable" money to this account. if I want to buy something I generally wouldn't buy... the "spare" money in this is for that. I put about 3% of my paycheque in here. Its kind of my "guilty pleasure" money. (i.e. tech toys, Video Games, Cosmetic Car stuff, etc)

Visa: If a place accepts visa, I use my visa instead of savings. When I get home, I look at the receipts and transfer money to the visa, before it even shows up. I do this mostly for the points. It'll help with the honeymoon!

E-savings - Some money set aside for my car - its going to need some major work sooner or later.

TSFA - Its just there... I don't touch it. I consider that the "Oh crap we both lost our jobs and we're going to lose the house" emergency money. (I'll also get raped by the tax-man if I ever do touch it)

Wedding Savings: I throw as much as I think I can afford on payday, and then most (75%) of any leftovers at the end of the month. I HAVE overestimated in the past and put too much in there on payday, but rather than taking it back out a week later, I try and live like a hobo until the next payday.

The last, and KEY thing that helps me manage money is actually Royal Banks' "My Finance Tracker" It's an online money manager that lets you set budgets for each "area" of spending.

At any time, I can look up exactly how much I spent, at what store, and when. I go in every week and check to make sure everything has been categorized. All this is key to realizing where you are hemmoraging money. (Interest, Starbucks, Monthly subscriptions, Dining out, etc)

True Story:

When Megan and I started dating (when I was "wooing" her) I was HORRIFIED to discover that my "entertainment" and "Dining" categories jumped up over $1200 a month. Now a days, I make sure we have 1-2 "Date nights" a month, and hanging out with friends either is watching a movie at someones house, or playing cards for 3 hours over a 5 dollar Bubble Tea at Forever Tea Shop Much cheaper than Movie theater + Dinner (80 dollars) or something similar. We re-discovered the lost art of "cheap" dates. A walk along the shoreline and an ice-cream cone replaced a night on the town.

Track your little expenses. Coffee is a bad one. Dining out (Guilty!) is also a huge expense. Packing a lunch costs about 2-3 bucks. Buying a lunch is usually 7-12 bucks. replace dining out with packing a lunch and you're saving over 1000 bucks a year - EASY.

So, A couple lifestyle choices, and we will have "saved" ourselves the wedding that we both have been looking forward to for many years!

Wednesday, January 9, 2013

Live Below your Means

"Live Below your Means"

Megan and I have a "4 walls" approach to our personal finances - As in, Our personal finances never leave "these four walls" and we don't talk about them with anyone else.

Talked it over with Megan, and because this is mostly about me, and it is the past (albeit a past that I'm still paying for) I'm OK to go a little more into depth.

If there are any students out there reading this, this is heads up of what is to come.

My Past:

Generally, You inherit your first bank account from your parents. The one they put your birthday money in when you were a kid. That's what happened to me. Living at home, I didn't have a need for even a debit card until I was 18 or so. As a result, I actually had a bit of money in my savings going into college.

That dried up. Completely. College was like this whirlwind of awesome times, that was fueled by money.

Problem Number 1:

Before it dried up, Royal bank gave me a visa card. I didn't ask for it - They just offered me one.

What 19 year old Alex saw was this: Free money, No monthly fees.

Problem number 2:

When I graduated college, I got a job that was about 50km away via 407 ETR, and they told me I HAD to have a car. So I bought my Mazda3, new. Its an awesome car, Its been great to me, and i'm going to drive it until it dies, or is not financially feasible to keep maintaining.

What ended up happening is that I was working, just to own my car. I barely made any money. It was a sales job, and my base salary barely covered my car and basic food/entertainment. When I made a deal (placed someone) I'd get about a $1,200 Payday, which I felt compelled to "reward" myself with, rather than save. (or pay off the little bit I had put on my visa)

Problem number 3:

The moment I got a better paying job, I was able to "afford" to move out. I had no "safety net" of cash anywhere, and I did not have the ability to "save" any money, as about 95% of my paycheque used for rent, Insurance, Gas, car payments, and food. So when money was eaten up by "unforeseen" expenses (like $500 side windows when my car was broken into 3 times) The visa, Otherwise known un-affectionately as "Cousin Vinnie", came in to "save the day"

Problem number 4:

Growing up, my parents rarely just bought us big ticket items. Generally what would happen is that I would be required to save up money to buy what I wanted (Sound Card, Bicycle, PlayStation, CD-Rom Drive, Computer, etc) (I was a nerdy kid) and most of the time, My parents would swoop in at the last second (usually at the checkout counter) and cover half of it as a Christmas gift or birthday gift or what have you. I never expected it, and I knew if I ever DID expect it, I'd be sorely surprised. I had to "earn" something completely, even if I didn't have to pay for it completely.

Apparently 8 year old Alex was smarter than 19-23 year old Alex.

This SHOULD have taught me the value of a dollar, and how to save my money... But once I moved out, I developed this "I'm an adult now and need to live like a successful adult" mentality.

I had this stupid impression that I didn't have to live thrifty or lower my quality of life... I just needed to make more money.

I had a false sense of entitlement, and bought things on impulse (I'd research the best value/features of whatever I was buying, and then buy it.) I still battle impulsive tendencies to this day, and there's a new 8 gallon aquarium I bought after Christmas in our foyer which reminds me daily of this fact.

So: When moving out and moving up in the world, If you can't buy it with cash because you don't have any... Don't Buy it.

Back on topic.

If I was spending every penny (and then some) just to "live"... What did I do when something out of the blue happened?

Cousin Vinnie. (The visa)

Royal bank just kept upping the limit without asking me, and I didn't complain. I don't ever think it was maxed out, but it took a while to realize I was paying well over 100 bucks in interest a month, and that it had become this monster.

So, a little aside - Girls - You cost a LOT to date.

Enter Megan. She moved out on her own about a year before I met her. Had an old used car, No monthly payments, and her idea of entertainment was really just sitting around, reading a book, and watching Dr. Phil. She was the Gift Card/Coupon queen, and luxuries were usually a result of Birthday/Christmas, she just managed them so she would have them last throughout the year.

I learned a thing or two, but She lived in Hamilton, I in Mississauga. I Still lived AT my means, but considering the amount of travel/date money I was spending, I was able to shift around my "costs" to keep my bank balances relatively level. Only once we moved in together (aka I stopped buying dinner for us both every other night) did I successfully lower our "quality of life" to a level that I could make headway and pay back "Cousin Vinnie"

Bottom line...

Keep your monthly expenses UNDER 60% of your wages. Put 20% away for Savings/RRSP, but the other 20% toward "spendable" money. (Groceries, Clothes, Entertainment.)

Monthly expenses include:

- Rent/Mortgage

- Insurance

- Water, Hydro, Natural gas

- Car Payments (and insurance)

- Phone

- Internet (Lets be honest, Internet is a Utility/Tool... TV is a luxury)

- I like to include gasoline

- Loan Payments

If you have any leftover money at the end of the month... reward yourself by putting it aside for a rainy day - That way you won't be screwed over when something bad happens. (and it WILL happen... budget for it!)

If you are paying off debt you've already got... it pays to pay it faster. Interest is really like that douchebag talking a little too loud about their personal workout routine at a nice restaurant - The longer you are aware of it, the more it pisses you off.

These are all lessons my parents taught me growing up, but I was just too young and stupid to heed their advice.

...now I'm just young and good looking ;-)

Next post is about

Sunday, January 6, 2013

Staying on top of your home...

So, after almost 6 months, I've figured out theres 4 ways of maintaining your home.

1: Don't.

1: Don't.

We saw a number of houses that were simply "used up" everything was worn down, half broken, blast from the pasts and nothing was updated. They're basically houses where you have to re-do everything. If you do this to your house, you're going to take a serious hit on its resale value. Sometimes a coat of paint will dress it up enough to show it, but any "seasoned" buyer will be able to see right through that... to the shag carpeting and the 30+ year old appliances.

2: Pay someone to do it. "Yuppie" style.

This costs the most money, but done right, it looks the best, if you can afford it.

Includes hiring a Landscaping companies, Paying a bit too much for things the average joe could probably do (Paint, Clean clogged drains, Mow Lawns, etc). While you're getting contractors in to do most of your projects/repairs, You'll still need to know at least a little bit to avoid being robbed by those people.

3: Maintain a perfect household.

This basically means - Keep it spotless, repair and clean every little thing that happens. It'll still "wear out" but a well maintained house that's dated shows a lot better than an abused and used house.

4: DIY Updates + Maintenance.

My selected method. I don't keep a spotless house, But I understand that a clean house is a house that stays nice. Dirt wears stuff out, so when I see something dirty, or slop something on the floor, I clean it right away. I need to keep doing little projects that will keep the house looking nice and new, so that it never "gets away" from me.

All these projects are really cosmetic in nature. For example, A fresh coat of Paint. New light fixture here and there. Replacing grungy switches and worn electrical sockets, Gardening. etc.

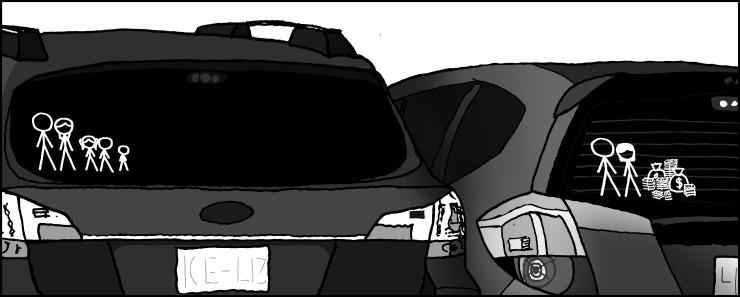

Some Jokes I made up over the past few weeks:

Home Ownership Might not be for you if...

1: Don't.

1: Don't. We saw a number of houses that were simply "used up" everything was worn down, half broken, blast from the pasts and nothing was updated. They're basically houses where you have to re-do everything. If you do this to your house, you're going to take a serious hit on its resale value. Sometimes a coat of paint will dress it up enough to show it, but any "seasoned" buyer will be able to see right through that... to the shag carpeting and the 30+ year old appliances.

2: Pay someone to do it. "Yuppie" style.

This costs the most money, but done right, it looks the best, if you can afford it.

Includes hiring a Landscaping companies, Paying a bit too much for things the average joe could probably do (Paint, Clean clogged drains, Mow Lawns, etc). While you're getting contractors in to do most of your projects/repairs, You'll still need to know at least a little bit to avoid being robbed by those people.

3: Maintain a perfect household.

This basically means - Keep it spotless, repair and clean every little thing that happens. It'll still "wear out" but a well maintained house that's dated shows a lot better than an abused and used house.

4: DIY Updates + Maintenance.

My selected method. I don't keep a spotless house, But I understand that a clean house is a house that stays nice. Dirt wears stuff out, so when I see something dirty, or slop something on the floor, I clean it right away. I need to keep doing little projects that will keep the house looking nice and new, so that it never "gets away" from me.

All these projects are really cosmetic in nature. For example, A fresh coat of Paint. New light fixture here and there. Replacing grungy switches and worn electrical sockets, Gardening. etc.

Some Jokes I made up over the past few weeks:

Home Ownership Might not be for you if...

- If you expect to actually park a car in that single car garage...

- If your building inspector tells you that your fireplace has a Flu, you ask them how to make it better.

- If you think your contractor is gay because he keeps looking for a stud.

Thursday, January 3, 2013

You've won a trip! How to avoid Social Hacking.

One of the things to dread when owning your own house is Cold-Calls

Cold Calls are essentially where someone makes contact with you, without knowing anything about you, In hopes to glean information from you and sell you a product, Sell your Info, or in some cases, Take your Assets or Identity.

They come 3 forms:

Mail:

Probably the easiest to discard and detect items high on the bogus scale.

Phone:

The Phone has this sense of closeness and personal communication that lacks in Mail or E-Mail. And, if you call BS, they can just hang up and call again later.

Today, I got an awesome phone call. I had apparently filled out a ballot at a store in the GTA that entitled me to a free vacation.

The man on the phone was very accented, and the area code was 716, Buffalo (which I quickly googled while trying to understand him)

I had two choices, a 5 day 4 night stay at any hotel in America, including Niagara falls (which is in "On-tear-eo" Or 4 days 3 nights at a resort in Mexico...

Both choices were open during the whole year, at my leisure.

I asked what the catch was. (There's always a catch) he said there was none. No cost to me. I Started asking questions, and he was asking why I wasn't excited. I told him I wasn't aware I filled out a form at walmart or zellers (?!?) I asked for more details.

he went very quickly to a scripted "I am calling from SuiteLife Vacations a BBB accredited organization at suitelifevacations dot com. You are 1 out of 150 winners of a choice of our 2 prizes.

I had more questions, but he quickly pushed the call along and asked why I wasn't excited. I flatly claimed that this seemed too good to be true and if I didn't get more details, I'd be hanging up. he started the script again, and I interrupted with "Whats the catch"

He went on a variation of his script saying that word of mouth advertising about their services is the best kind (true) and that My prize was usable untilt he end of 2013, to a destination of my choice.

He asked some very generic questions which I simply responded yes or no. He asked if My household income was 70 thousand 70 hundred. I just said yes. he asked if I lived with someone, I said yes.

I then asked him what information was on the ballot, and he deflected, saying that his manager would call me back with my prize code. I hesitantly said OK... and then hung up

I then asked him what information was on the ballot, and he deflected, saying that his manager would call me back with my prize code. I hesitantly said OK... and then hung up

10 minutes later, I surprisingly actually got a call from his "manager"

However, I had googled. This place is a borderline illegal scam.

Basically, your "prize" is a trip to a hotel anywhere in the US, where you pay all transportation, food, and fees/taxes. Your hotel is "free" but you have to pay $17 US to reserve your prise booking, and then $40 in Booking Fees, and then $75 for some gratuity fee or something.

On top of that, you have to drive to Woodbridge (industrial area) for a 1 hour meeting, where they promise you dinner (steak or chicken) and then don't deliver unless you buy an upgraded package.

Many people have reported flying down to their destination, renting a car, and showing up at their "hotel" just to pay all but the basic 40 dollars a night rate (Taxes, fees, etc not included)

So, When the guy called back, I asked him one simple question: "Whats my name?"

He started the spiel of "I am calling from suitelife"... I interrupted him and said "What is my name?... if I filled out a ballot, you'd have more than just my phone number."

(I started to laugh thinking of American Pie: "Say my name B!tch")

I told him that any reputable company would know the name of someone who just won a prize. i told him i also googled the company, and that you have a C- Rating on BBB, and there are many unresolved complaints of people being stranded at your destinations. I told him to remove me from his caller list and databases. He got angry at me for 'turning down a prize" and hung up on me mid sentence.

Just one example!

Bottom line: If someone is calling you, They should have your info already. Don't give it up willingly. Ask them where they got your number. Ask them your own address. Don't give them anything they don't already have. Don't verify what they DO have until you are sure they are reputable. Check the BBB Website for their company name. Not listed or below B+ Grade? Hang up!

Also, if someone calls from Microsoft - Hang up.

Final type: In Person

This is a tough one. Most people are naturally weary of someone coming to their door. As soon as I see a clipboard, I know someone is selling something (Cookies, Gas, Frozen meat?!?)

But if there's no clip board, I'm thinking "this guy is sketchy..." So the Clip Board is a double edge sword.

When someone comes to your door, Common sense is required.

I've never had to do this, I don't know anyone who's had to do this, but I've heard of a few things that can help you if you have someone showing up regularly who is not wanted at all, and won't get the hint, now matter how nice, or firm you are. First, Find out what company/group they are from. This way, you can confirm they are from the same group/company and are "harassing" you and it will allow you to make good on the end all of rejection statements:

"Please leave. This is your notice that YOU, and ALL the Employees/Members of your company/group are no longer permitted on MY property. Further visits will be construed as Harassment, and anyone found on MY property in the future will be photographed and/or charged with trespassing"

That'll pretty much send anyone running for the hills, and is completely legal and not a physical threat that can come back to bite you in the ass.

Harassment: (Quoted from Canadian Criminal Code, Section 264)

"No person shall, without lawful authority and knowing that another person is harassed or recklessly as to whether the other person is harassed, engage in (the following) conduct ...that causes that other person reasonably, in all the circumstances, to fear for their safety or the safety of anyone known to them:

Is kind of a fluff charge. If someone is trespassing, you call the police. If they are still on site, you explain tot he police that you asked them to leave, and they are trespassing. They'll issue a trespassing warrant. If that person breaks the conditions (effectively a restraining order) and shows up again, THEN they are in some deep doodoo. That's what the "photographed" bit is for.

You do have the legal right to "defend" your real property or dwelling from trespassers. (within reason) a Trespasser is anyone you have told are no longer welcome on your property or dwelling.

The bottom line:

Home Ownership means you have some sort of asset. (aka "worth")

You have something that everyone else wants to get - Some in less honest ways then others.

Your "firewall" is your common sense - sadly there isn't an anti-spam program for Life!

Cold Calls are essentially where someone makes contact with you, without knowing anything about you, In hopes to glean information from you and sell you a product, Sell your Info, or in some cases, Take your Assets or Identity.

They come 3 forms:

- Phone

- In person

Mail:

Probably the easiest to discard and detect items high on the bogus scale.

- Prizes and Raffles

- 3rd Tier Gas Companies

- "URGENT" letters without your name on them

- "PAST DUE" notices without your name on it

- "Pre approved" fake paper credit cards

Phone:

The Phone has this sense of closeness and personal communication that lacks in Mail or E-Mail. And, if you call BS, they can just hang up and call again later.

Today, I got an awesome phone call. I had apparently filled out a ballot at a store in the GTA that entitled me to a free vacation.

The man on the phone was very accented, and the area code was 716, Buffalo (which I quickly googled while trying to understand him)

I had two choices, a 5 day 4 night stay at any hotel in America, including Niagara falls (which is in "On-tear-eo" Or 4 days 3 nights at a resort in Mexico...

Both choices were open during the whole year, at my leisure.

I asked what the catch was. (There's always a catch) he said there was none. No cost to me. I Started asking questions, and he was asking why I wasn't excited. I told him I wasn't aware I filled out a form at walmart or zellers (?!?) I asked for more details.

he went very quickly to a scripted "I am calling from SuiteLife Vacations a BBB accredited organization at suitelifevacations dot com. You are 1 out of 150 winners of a choice of our 2 prizes.

I had more questions, but he quickly pushed the call along and asked why I wasn't excited. I flatly claimed that this seemed too good to be true and if I didn't get more details, I'd be hanging up. he started the script again, and I interrupted with "Whats the catch"

He went on a variation of his script saying that word of mouth advertising about their services is the best kind (true) and that My prize was usable untilt he end of 2013, to a destination of my choice.

He asked some very generic questions which I simply responded yes or no. He asked if My household income was 70 thousand 70 hundred. I just said yes. he asked if I lived with someone, I said yes.

I then asked him what information was on the ballot, and he deflected, saying that his manager would call me back with my prize code. I hesitantly said OK... and then hung up

I then asked him what information was on the ballot, and he deflected, saying that his manager would call me back with my prize code. I hesitantly said OK... and then hung up10 minutes later, I surprisingly actually got a call from his "manager"

However, I had googled. This place is a borderline illegal scam.

Basically, your "prize" is a trip to a hotel anywhere in the US, where you pay all transportation, food, and fees/taxes. Your hotel is "free" but you have to pay $17 US to reserve your prise booking, and then $40 in Booking Fees, and then $75 for some gratuity fee or something.

On top of that, you have to drive to Woodbridge (industrial area) for a 1 hour meeting, where they promise you dinner (steak or chicken) and then don't deliver unless you buy an upgraded package.

Many people have reported flying down to their destination, renting a car, and showing up at their "hotel" just to pay all but the basic 40 dollars a night rate (Taxes, fees, etc not included)

So, When the guy called back, I asked him one simple question: "Whats my name?"

He started the spiel of "I am calling from suitelife"... I interrupted him and said "What is my name?... if I filled out a ballot, you'd have more than just my phone number."

(I started to laugh thinking of American Pie: "Say my name B!tch")

I told him that any reputable company would know the name of someone who just won a prize. i told him i also googled the company, and that you have a C- Rating on BBB, and there are many unresolved complaints of people being stranded at your destinations. I told him to remove me from his caller list and databases. He got angry at me for 'turning down a prize" and hung up on me mid sentence.

Bottom line: If someone is calling you, They should have your info already. Don't give it up willingly. Ask them where they got your number. Ask them your own address. Don't give them anything they don't already have. Don't verify what they DO have until you are sure they are reputable. Check the BBB Website for their company name. Not listed or below B+ Grade? Hang up!

Also, if someone calls from Microsoft - Hang up.

Final type: In Person

This is a tough one. Most people are naturally weary of someone coming to their door. As soon as I see a clipboard, I know someone is selling something (Cookies, Gas, Frozen meat?!?)

But if there's no clip board, I'm thinking "this guy is sketchy..." So the Clip Board is a double edge sword.

When someone comes to your door, Common sense is required.

- Don't sign anything.

- Don't Show Fear.

- Don't Let them run the conversation - Control it yourself, Ask them questions. It'll throw them off of their routine, but it'll also get you the information you need to quickly Dismiss or engage them further if you want.

- Don't tell them when you won't be home, Just tell them when the "best time" to reach you is.

- Don't Invite them in - Let them freeze and talk to them from the doorway.

- Don't be mean. There's a few reasons why I say this:

- If you're not memorable, its a good thing

- If they are someone with bad intentions, You're more likely to be targeted

- If you're not interested, Speak strongly but nicely that you are not interested.

I've never had to do this, I don't know anyone who's had to do this, but I've heard of a few things that can help you if you have someone showing up regularly who is not wanted at all, and won't get the hint, now matter how nice, or firm you are. First, Find out what company/group they are from. This way, you can confirm they are from the same group/company and are "harassing" you and it will allow you to make good on the end all of rejection statements:

"Please leave. This is your notice that YOU, and ALL the Employees/Members of your company/group are no longer permitted on MY property. Further visits will be construed as Harassment, and anyone found on MY property in the future will be photographed and/or charged with trespassing"

That'll pretty much send anyone running for the hills, and is completely legal and not a physical threat that can come back to bite you in the ass.

Harassment: (Quoted from Canadian Criminal Code, Section 264)

"No person shall, without lawful authority and knowing that another person is harassed or recklessly as to whether the other person is harassed, engage in (the following) conduct ...that causes that other person reasonably, in all the circumstances, to fear for their safety or the safety of anyone known to them:

- Repeatedly following from place to place the other person or anyone known to them;

- Repeatedly communicating with, either directly or indirectly, the other person or anyone known to them;

- Besetting or watching the dwelling-house, or place where the other person, or anyone known to them, resides, works, carries on business or happens to be; or

- Engaging in (such) threatening conduct directed at the other person or any member of their family."

Is kind of a fluff charge. If someone is trespassing, you call the police. If they are still on site, you explain tot he police that you asked them to leave, and they are trespassing. They'll issue a trespassing warrant. If that person breaks the conditions (effectively a restraining order) and shows up again, THEN they are in some deep doodoo. That's what the "photographed" bit is for.

You do have the legal right to "defend" your real property or dwelling from trespassers. (within reason) a Trespasser is anyone you have told are no longer welcome on your property or dwelling.

The bottom line:

Home Ownership means you have some sort of asset. (aka "worth")

You have something that everyone else wants to get - Some in less honest ways then others.

Your "firewall" is your common sense - sadly there isn't an anti-spam program for Life!

Tuesday, January 1, 2013

Hardwood Floors

This is perhaps more of a rant than a post.

Hardwood floors are a PAIN.

First, lets put it out there. My Fiance is sometimes..clumsy... "accident prone". The dial tone of many cell phones has flat-lined under her care.

So keeping that in mind, with Life, comes accidents. By us, By Guests, contractors, etc.

When you drop something on a hardwood floor - It dents it.

When you drag a chair across it, It scuffs and scratches it.

When you spill something into the cracks of it - it stains it.

When you walk along it - It creaks and groans.

When you don't clean up the slightest dust/sand - it ruins it.

The "industry" recommends you wax/refinish your floors once or twice a year. This is HARD work, on your hands and knees. I do NOT look forward to doing this, but I think I'll be doing this sooner rather than later. Leaving it too long will permanently marr the floors and make it much more difficult to restore in the future.

But... it looks good.

Maybe our house has cheaper hardwood floors, but I've scrubbed them down with a vinegar and water solution twice since we moved, and while they look "clean" they are definitely more "worn" than when we bought the house.

Another PITA (Pain In The...) Is the fact that most people don't rip up their cabinets/closet floors when putting hard wood floors after the fact. I want my fridge and my stove to swap places, but it involves moving a bank of cupboards over by 2 inches. The project is on hold because of the crazy amount of tools/work I'll have to buy/rent/invest in, to trim the hard wood floor back 2 inches so I can slide my cupboard over. Just something to look out for when you're looking at a house with hardwood floors.

There are two different types of Hardwood floors:

Waxed, which penetrates the wood and protects it. These are typically Older (50-60 years old)

Surface Finished (polyurethane) This coats the top of the wood, and is standard for most new hardwood floors.

Helping to keep the floors clean are Entryway Carpets - One by all the doors into your house. These collect dust and grit which can help keep your floors clean. What you might want to avoid is Rubber bottomed Rugs - The rubber (or any petroleum product) can react with the polyurethane coating on your hardwood and cloud it. Often leaving a grid pattern commonly found on the bottom of "non slip" rugs.

So, keep an eye on the floors when you buy a house - They look amazing, and CAN be low maintenance, but if your dropping stuff, have Big Dogs, Younger Kids, (or a somewhat clumsy significant other)... You might want to think twice about hardwood floors, unless they're the kind that look great "weathered" and aged.

If you have any secrets to maintaining a nice looking hard wood floor, Please leave a comment!

Hardwood floors are a PAIN.

First, lets put it out there. My Fiance is sometimes..

So keeping that in mind, with Life, comes accidents. By us, By Guests, contractors, etc.

When you drop something on a hardwood floor - It dents it.

When you drag a chair across it, It scuffs and scratches it.

When you spill something into the cracks of it - it stains it.

When you walk along it - It creaks and groans.

When you don't clean up the slightest dust/sand - it ruins it.

The "industry" recommends you wax/refinish your floors once or twice a year. This is HARD work, on your hands and knees. I do NOT look forward to doing this, but I think I'll be doing this sooner rather than later. Leaving it too long will permanently marr the floors and make it much more difficult to restore in the future.

But... it looks good.

Maybe our house has cheaper hardwood floors, but I've scrubbed them down with a vinegar and water solution twice since we moved, and while they look "clean" they are definitely more "worn" than when we bought the house.

Another PITA (Pain In The...) Is the fact that most people don't rip up their cabinets/closet floors when putting hard wood floors after the fact. I want my fridge and my stove to swap places, but it involves moving a bank of cupboards over by 2 inches. The project is on hold because of the crazy amount of tools/work I'll have to buy/rent/invest in, to trim the hard wood floor back 2 inches so I can slide my cupboard over. Just something to look out for when you're looking at a house with hardwood floors.

There are two different types of Hardwood floors:

Waxed, which penetrates the wood and protects it. These are typically Older (50-60 years old)

Surface Finished (polyurethane) This coats the top of the wood, and is standard for most new hardwood floors.

Helping to keep the floors clean are Entryway Carpets - One by all the doors into your house. These collect dust and grit which can help keep your floors clean. What you might want to avoid is Rubber bottomed Rugs - The rubber (or any petroleum product) can react with the polyurethane coating on your hardwood and cloud it. Often leaving a grid pattern commonly found on the bottom of "non slip" rugs.

So, keep an eye on the floors when you buy a house - They look amazing, and CAN be low maintenance, but if your dropping stuff, have Big Dogs, Younger Kids, (or a somewhat clumsy significant other)... You might want to think twice about hardwood floors, unless they're the kind that look great "weathered" and aged.

If you have any secrets to maintaining a nice looking hard wood floor, Please leave a comment!

Subscribe to:

Posts (Atom)